Allbirds: The fall of Tech Bro's 'It' Shoe

Allbirds shoes once were referred to as ‘the world’s most comfortable sneakers and the Tech Bro ‘It’ Shoe’. The company went public in November 2021 raising over $300M in its IPO at a valuation of $2.2 billion.

And then… the Tech Bros Moved On.

Their CEO Joey Zwillinger stated during the quarterly call (PDF) last year:

“...2022 came to a challenging close as we ended the year below our guidance range, ending the year with nearly $300 million in net revenue, representing 7% YOY growth. Our adjusted EBITDA for the year was negative $60 million. Like the industry, we were impacted by weakened consumer demand – but we also made some strategic and executional missteps that impacted results.”

Back in 2014 Brown, the just retired All White soccer player, teamed up with engineer Zwillinger to make sustainable leisure footwear from Merino wool.

People loved the product and an NPS score of 86, great retention with 53% of sales coming from repeat customers in 2020 and the fact that they sold eight million pairs of shoes to over four million customers globally was the proof.

But looking closer one would have noticed it’s not all smooth sailing from there.

Allbirds were making an operating loss of about $29.2 million 2020 yet the company has transitioned to what it calls “full-funnel” marketing. That’s Latin for “we raised a ton of cash, and we’re now pouring it into television and print.”

As per the IPO prospectus, they spent a little over $55 million in 2020 and $44 million in 2019 on marketing.

And generated $219 million and $193 million in net revenue respectively.

Given 54 percent in 2019 and 47 percent in 2020 revenue was generated by new customers leaves us with around $100 million new customers revenue each year.

They also vaguely mentioned that the “average order value further expands from a strong level of $124 on a gross basis in 2020”. So assuming $100 net AOV given that’s the price of their best-seller as well.

So all gets us to assume around 800,000 new customers in 2020 which leads us to estimate a CAC of $69 a 25 percent increase from the 2019 level.

Now, there’s no mention of CAC value and trend in the prospectus.

Customer Acquisition Costs are mentioned only 3 times while brand awareness is mentioned 27 times.

Now, imagine everything described above happened before Apple privacy changes so I wouldn’t be surprised if the CAC doubled.

So, there were only a few options for them to continue growing and attempt to become profitable at the same time.

Reduce CAC

Increase average revenue per customer (ARPU)

And all that while reaching new customers.

CAC reduction

Everyone who ever managed paid media acquisition knows that you can’t scale it indefinitely. Once the core audience is saturated growth plateaus and CAC starts increasing with every extra dollar spent on ads.

Reducing paid media CAC would have been virtually impossible unless they tried to reach new audiences via successful new product line development but that later.

The other alternative is to invest in brand as a means to increase organic growth and the word of mouth referrals so as to reduce blended CAC while keeping paid CAC stable.

And the most feasible ways to build brand for a shoe company are content creation and/or standing for something bigger than selling shoes.

Content creation

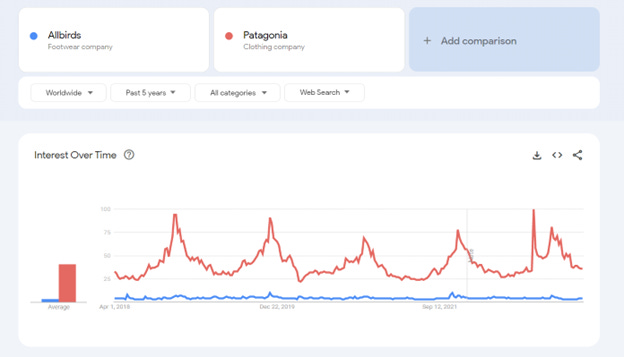

Let’s look at Allbird's competitors who succeeded as content creators.

Two companies stand out here.

If we plot their content strategies onto the Entertainment Value Curve we see why.

Allbirds could have tried to position themselves somewhere along the curve, yet they focused on product promotion at times trying to be funny, at times inviting occasional celebrity.

A quick comparison of their Lindsey Lohan featured Unexpected Athlete (42K views, 800 likes) with Salomon’s ft. Rich Roll Dear Rich video (300K views, 5.6K likes) shows where they are falling short.

Allbirds’ video is a celebrity featuring ad.

Salomon’s is a story many viewers would connect emotionally with.

With this video, Allbirds is competing in a very saturated market for the hearts and minds of the “always a fashionista sometimes a runner” audience with the market leaders launching collaborations with fashion houses i.e Adidas x Stella McCartney or Prada.

And this is the race Allbirds can’t possibly win.

Salomon taps into the network effects of an interconnected community of trail runners, starting a growth loop that feeds on itself.

Brand with purpose

Now, the brand indeed tried to stand for something bigger than shoes.

After all, a B-corp focused on sustainable and environmentally friendly practices in its supply chain.

Even their Allbirds’ original prospectus was filed as an SPO — a “Sustainable” Public Equity Offering. The company later amended its prospectus to include no mention of an SPO.

What they missed, however, is being sustainable and environmentally friendly is not a moat.

And it's not just the competition from established players, there are plenty of purpose-driven newcomers making a more compelling sustainability case.

One such example is Kilian Jornet’s NNormal.

Making the bold and loud statement that true sustainability is about using less and buying less and if Kilian can complete his unbelievable endurance wins only with 4 pairs of shoes you surely can.

Increase ARPU

Getting current users to spend more would inevitably require launching new products both in the same category and developing new categories.

Product development

As their product portfolio expansion strategy, Allbirds went from sneakers for the office to sneakers for trails.

What they seem to miss is that there’s a huge difference between buying fashion and buying sports gear.

I’ll get a little personal here as someone who spent a little fortune on sportswear especially running, hiking, and mountaineering gear.

Do you know what I’m thinking about here?

God bless The North Face 🙂

Because many times it was the gear from the right brand to spare me from a few bruises… to say the least.

So what are the chances of me switching because Allbirds claimed that they rigorously tested their shoes?

In the end, their CEO also admitted.

“We made a decision to diversify our product beyond the core DNA of what has made us one of the most beloved brands in footwear in an effort to reach a younger, fashion-forward and performance-oriented consumer…And while these products did succeed in attracting new consumers to our brand, they had lower conversion and sell-through than our classic styles across channels. Ultimately, we have come to recognize that our over-investment on newness came at the expense of focus on consumers who are loyal to our brand”

It all started so well but then a niche brand decided to raise tons of venture capital funding on the premise of unlimited growth and the belief that everyone on earth who wears shoes would need their sneakers.